Asset Allocation – A Key to Successful Investing

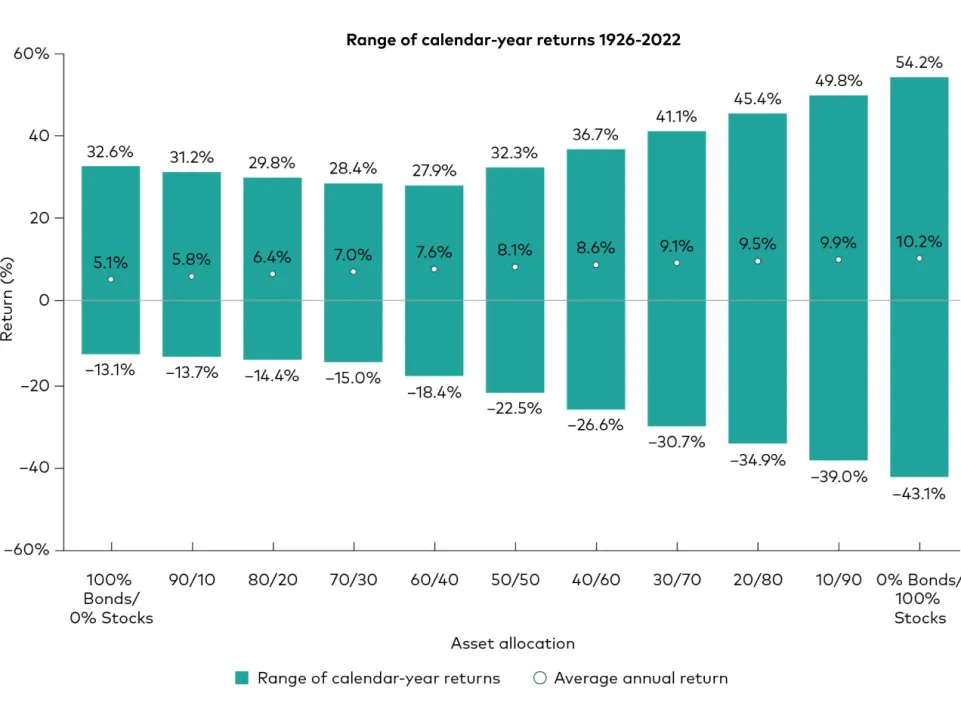

Asset allocation is the strategic distribution of investments across various asset classes, including stocks, bonds, real estate, and cash, to optimize risk and reward. A well-crafted asset allocation plan can significantly impact your financial success.

The principle of asset allocation is grounded in the belief that a diversified portfolio can reduce risk and enhance potential returns. By spreading investments across different asset categories, you can better protect your portfolio against market fluctuations.